Cryptocurrency is starting to gain a reputation as a safe haven investment, much like gold and other metals. But that’s not the only reason investors should diversify their investment portfolio with bitcoin and altcoins( Lokum Finance). The shock of the pandemic has prompted businesses to accelerate their digital infrastructure which includes tech-enabled and remote financial services. Virtual currencies have stepped in to fill that need. In fact, they’ve been ramping up to do so for quite some time and the pandemic has been the main accelerator. Banks are racing to roll out crypto-based services which include withdrawals, deposits, and payment transfers via digital wallets.

We are going to discuss a new project which is called Lokum Finance

Lokum Finance has been listed at DappRadar, the starting point for dapp discovery, and acts as a distribution channel for dapp developers that are looking to reach new consumers. LokumFinance is a robotized automated market maker (AMM) a decentralized record (DeFi) application that licenses customers to exchange tokens It's launched in April 2021 and is a decentralized exchange for swapping BEP-20 tokens on Binance Smart Chain. LokumFinance uses an automated market maker model where users trade against a liquidity pool and these pools are filled by users who deposit their funds into the pool and receive liquidity provider (LP) tokens in return. These tokens can later be used to reclaim their share of the pool as well as a portion of the trading fees.

LokumFinance is an automated market maker (AMM) — decentralized finance (DeFi) application that allows users to exchange tokens, providing liquidity via farming and earning fees in return. LokumFinance uses an automated market maker model where users trade against a liquidity pool These pools are filled by users who deposit their funds into the pool and receive liquidity provider (LP) tokens in return.

Components of DeFi

Outlined below are the four layers that comprise the DeFi stack.

• Settlement Layer: The settlement layer is also referred to as Layer 0 because it is the base layer upon which other DeFi transactions are built. It consists of a public blockchain and its native digital currency or cryptocurrency. Transactions occurring on DeFi apps are settled using this currency, which may or may not be traded in public markets. An example of a settlement layer is Ethereum and its native token ether (ETH) which is traded at crypto exchanges. The settlement layer can also have tokenized versions of assets, such as the US dollar, or tokens that are digital representations of real-world assets. For example, a real estate token might represent ownership of a parcel of land.

• Protocol Layer: Software protocols are standards and rules written to govern specific tasks or activities. In parallel to real-world institutions, this would be a set of principles and rules that all participants pertaining to a given industry have agreed to follow as a prerequisite to operating in the industry. DeFi protocols are interoperable, meaning they can be used by multiple entities at the same time to build a service or an app. The protocol layer provides liquidity to the DeFi ecosystem. An example of a DeFi protocol is Synthetix, a derivatives trading protocol on Ethereum. It is used to create synthetic versions of real-world assets.

• Application Layer: As the name indicates, the application layer is where consumer-facing applications reside. These applications abstract underlying protocols into simple consumer-focused services. Most common applications in the cryptocurrency ecosystem, such as decentralized cryptocurrency exchanges and lending services, reside on this layer.

• Aggregation Layer: The aggregation layer consists of aggregators who connect various applications from the previous layer to provide a service to investors. For example, they might enable seamless transfer of money between different financial instruments to maximize returns. In a physical setup, such trading actions would entail considerable paperwork and coordination. But a technology-based framework should smoothen the investing rails, allowing traders to switch between different services quickly. Lending and borrowing is an example of a service that exists on the aggregation layer. Banking services and crypto wallets are other examples.

To develop, you first need to offer liquidity to one of the pools, which you can find on the Farms page. After providing liquidity and receiving LP tokens by that time, select the pool you have joined on the Estates page, confirm your consent and then click on the small “+” sign, select the amount to be wagered and confirmed.

How can I link my wallet to LokumFinance?

To link your wallet, you need to click on the “Open wallet” button in the upper right corner of the page. Starting now and for the foreseeable future, look for the wallet you need to interact with LokumFinance and link a “partner”.

How can I set up my wallet on Binance Smart Chain?

Trust Wallet: When you go to dAPP in the upper right corner, you see certain blockchains open, click on it, then select Binance Smart Chain Mainnet.

MetaMask: Create your own RPC with

network name: BSC

Mainnet New RPC URL: https://bsc-dataseed.binance.org/

ChainID: 56

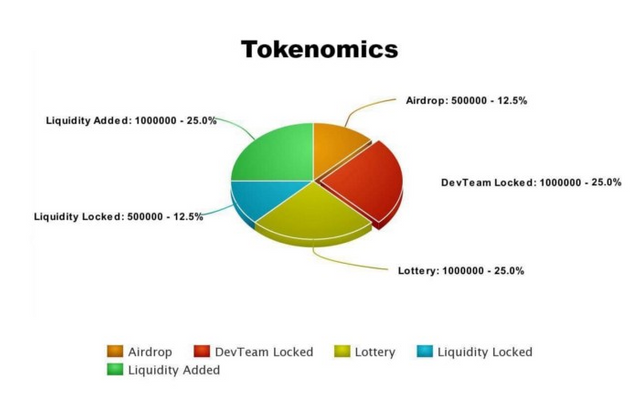

BNB Block Explorer URL: https://bscscan.com/ Tokenomics

Token : $LKM

Chain : Binance Smart Chain (BEP-20)

Smart Address: https://bscscan.com/token/0x1099E778846bAa6aAD3C6F26Ad42419AA7f95103

Starting Supply: 4,000,000 $LKM

Supply limit: NO

Starting Price: ~ 1.00$

Starting Emission Rate: 1 $LKM per block

Security

Migrator Code: To ensure complete security, the Migrator Code has been removed from our contract with MasterChef.

Transfer of ownership: in order to achieve independence, the owner of the LKM will be transferred to a farm contract, which will increase liquidity.

Tokenomics

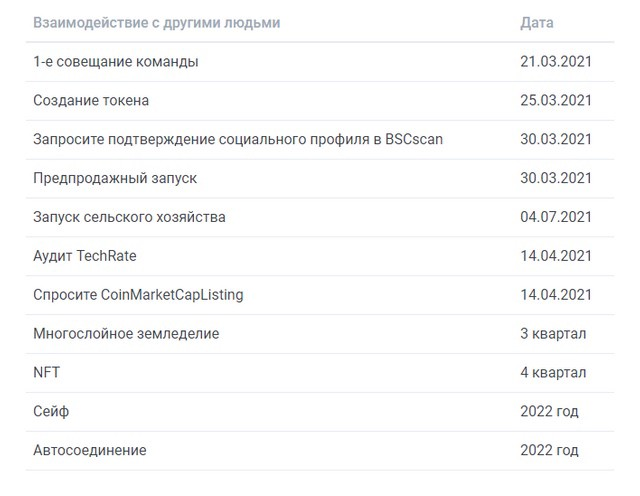

Roadmap

For more information please visit the links below:

Website : https://lokum.finance/

Whitepaper : https://docs.lokum.finance/

Twitter : https://twitter.com/FinanceLokum

Instagram : https://instagram.com/lokumswapfinance

Telegram : https://t.me/lokumswapfinance

Author : Maniecool

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=1692995

Telegram Username: @maniecool_XRM

Bep 20 Address: 0xD6dB7AB5afc298155F3D53c14Fa1934e6122f2f2

No comments:

Post a Comment