Blockchain technology has gotten to the level in which the whole world cannot do without it. We have discovered that this technology is making the news headline everyday which symbolizes global and rapid adoption of this technology. But despite the greatness and potential of this technology, there are still some things that needed to be improved upon its use. We have several and different blockchain network such as bitcoin blockchain, Ethereum blockchain, eos blockchain, tron blockchain and some other more. The level of difficulties associated with each of this blockchain network varies based on the type of blockchain.

We have some blockchain that are more cumbersome and difficult to use than some others, we also have some that easy to use but they are lacking some other qualities. Let’s take for example the speed of transaction which is solely dependent on the nature of blockchain transaction. Some transactions do take several hours before it could be confirmed on the blockchain network, some blockchain also charges high transaction and mining fees. This is the reason why a new team has gathered around to rectify this problem by launching a new blockchain project known as Buckscake

BucksCake as a smart exchange platform is a cutting-edge Erc20 blockchain DeFi Based exchange platform. on the other hand, Decentralized finance (otherwise known as DeFi) is a blockchain based form of finance that does not rely on central financial intermediaries such as brokerages, exchanges, or banks to offer traditional financial instruments, and instead utilizes smart contracts on blockchains, the most common being Ethereum.

BucksCake has an exceptional power to redefine the view of all investors in the World of DeFi in a way that offers the best services ever in terms of earning money through staking , yield farming and cloud mining on the platform with simply zero risk of loosing their investments.

Feature of BucksCake:

1) Ultra-liquid: Consumers are involved in putting their tokens with Uniswap's liquidity provider. Credits from these tokens are being farmed. The proportion of such commissions shall be allocated according to an independent policy, such as the liquidity of the LP token, and shall be transformed into (ETH-BKC) buybacks (increasing the price). Any bought tokens of the BKC will be sent to the stakers/farmers.

2) Inflation Proof: The BKC has a clear effect on each token. Any time the BKC token is exchanged, the farmers are paid a small reward. This mechanism of work promotes planting and farming. The maximum number of BKC tokens is 450,000. And there's never going to be any like them.

3) Community control: BKC holders would be allowed to vote on different plans as long since they have a share of liquidity in the pools. The Group can decide anything from developer charges and site construction to connections to unique farm choices.

BKC Token

BKC is an ERC20 token and is used in every service available at BucksCake. The maximum supply is 450,000 BKC tokens. Tokens are deflationary and the burning mechanism will destroy tokens that are being farmed and staked after a while, leaving the final token amount (450,000-90,000) tokens. In total, up to 90,000 tokens will be removed from the ecosystem and reports will be published in our community.

•Distribusi•

The initial BKC will be distributed during the pre-sale event, where a portion of the ETH received will be exchanged for the BKC that delivers its first "price pump" project. After the pre-sale ends, unsold BKCs will be distributed among users as a one-time subsidy. As indicated earlier, BKC has no mining capability, the BKC limit (450,000) is fixed forever. There's no way to release more BKCs. The part of the unsold BKC will be used to add liquidity to other DEX platforms such as SushiSwap, and some of this will be distributed as an Airdrop to the first investors and media partners and some will be burned.

• Bet •

The BKC staking protocol allows users to stake ETH, USDT, DAI, USDC, WBTC, BNB (ERC20) and of course BKC using a special Staking DApp. With a 72 hour lockout period, users can immediately control their own tokens. The BKC Staking DApp can be found at: ssilka Unlike other platforms, BKC offers a fixed% return on their staked assets rather than offering an introductory high APR, which usually diminishes over a period of time. Our cuts ensure long-term stability with the current state of the token structure and a limited amount of 450,000 BKC as there are no mint terms in our token contracts.

Staking on our platform is designed to be as fast and easy as possible. With a single lockout period of 72 hours, users can enjoy the benefits of staking on our platform. Users can withdraw their funds at any time after the end of the lockout period. The prizes earned can be collected without any commission, excluding current gas prices. The token staked on our platform will reduce the available circulating supply, which will have a positive impact on the BKC price.

• Agricultural produce •

Yield Farming, or as some call it Liquidity Mining, is a major pillar of DeFi's progress in the blockchain space. Yield Farming is a way to collect income from invested funds. BKC Farming allows you to get rewarded for providing liquidity across multiple liquidity pools. Users will be given a guaranteed payment of the Uniswap commission. The amount of the prize depends on the number of tokens provided for pool liquidity. The more members who join the base, the less each member will receive in the long run. When you add liquidity to the pool, you receive UNIv2 tokens (BKC-ETH) for the wallet you use to add liquidity. This token is your access to the current farm pool on the BKC platform.

• Vault returns •

User Section A: (UNI-V2 is kept by you, I contract the total balance of UNI-V2) For example if there are 9,000 UNI-V2 (BKC / ETH) tokens collected in this Vault, and the user deposits 1000 UNI-V2. The total balance of token contracts collected by UNI-V2 (BKC-ETH) is 10,000. And User A's share now is: 1000 / 10,000 = 10% If user "B" deposits another 10,000 UNI-V2 (BKC-ETH) Tokens collected into this vault, the total contract balance of the UNI-V2 (BKC-ETH) Token which is collected to 20,000. User A's new share becomes: 1000 / 20,000 = 5% If 200 BETH2 tokens are distributed to this vault per month, User A's earnings will be 200 x his share in% In the 5% share, his earnings will be 200 x 5% = 10 BETH2

Token

BKC BKC is the token ERC20 and used by all the services provided by BucksCake. The maximum supply is 450,000 BKC tokens. Tokens can shrink and the incineration mechanism destroys the farm and stakes tokens after a while, leaving the final token amount (450,000–90,000) in tokens. A total of 90,000 tokens will be removed from the ecosystem and a report will be posted to the community.

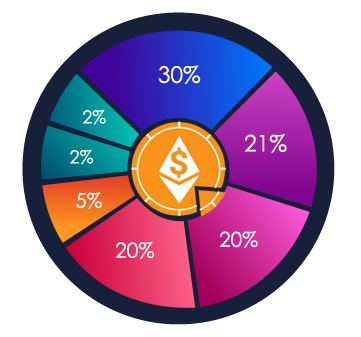

Token Distribution

Token Staking

Yield farming

Vault Returns

Vault Returns

Road Map

For More Information about this project please visit the links below :

Website: https://buckscake.com

Whitepaper: https://buckscake.com/whitepaper.pdf

Twitter: https://twitter.com/bucks_cake

Telegram Group: https://t.me/BucksCakePublicChat

Author: Maniecool

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=1692995

Telegram Username: @maniecool_XRM

POA: https://bitcointalk.org/index.php?topic=5322052.msg56710522#msg56710522

Eth Address: 0xc7a5bdAa10D8C40f7a7FAF35995C794bB769166b

No comments:

Post a Comment